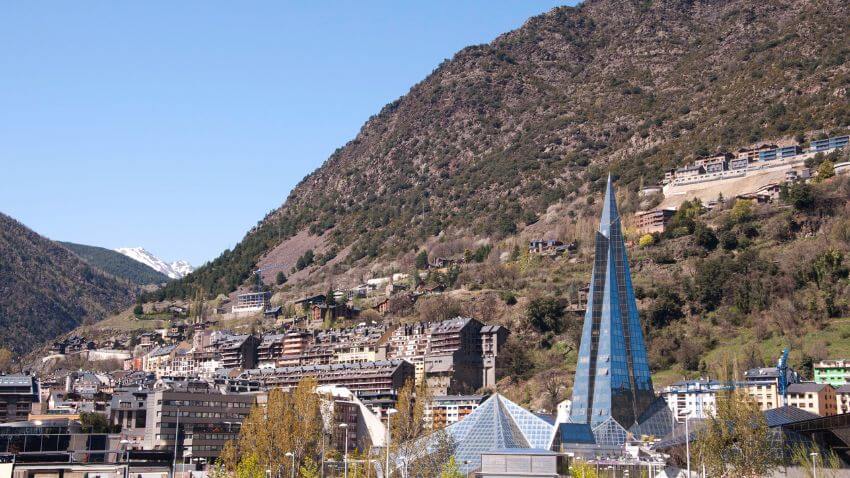

Andorra, a small yet captivating country nestled in the heart of the Pyrenees mountains between Spain and France, is increasingly becoming an attractive destination for entrepreneurs from around the globe. Its business-friendly environment, low tax rates, and high quality of life make it an ideal place to establish a company or pursue a career as a digital nomad. One crucial aspect of making the most of the opportunities Andorra offers is obtaining residency, which comes with its own unique advantages and requirements.

In this article, we will explore the benefits of residency in Andorra for entrepreneurs, discuss the types of residency available, and outline the application process and maintenance requirements to help you make an informed decision about your next business venture. If you need any help with the process, get in contact with the consultants from Andorra Lawyers.

Table of Contents

Advantages of Residency in Andorra

Andorra is well-known for its low tax rates, which make it an appealing destination for entrepreneurs and business owners. The country boasts a relatively low personal income tax rate, with a maximum rate of just 10%. This can result in significant savings for entrepreneurs when compared to other European countries, allowing them to invest more capital into their businesses.

The corporate tax rate in Andorra is also highly competitive, with rates ranging from 2% to 10%. These low rates are designed to attract businesses and stimulate economic growth in the country, providing entrepreneurs with a financially advantageous environment to grow their ventures.

In addition to the financial benefits, Andorra offers a high standard of living for its residents, which can be a significant draw for entrepreneurs looking to relocate. The country’s healthcare system is known for its excellent quality and accessibility, with residents having access to both public and private healthcare options. Andorra’s education system is highly regarded, offering a variety of public and private schools and a multilingual education system that teaches in Catalan, Spanish, French, and English. Furthermore, Andorra is considered one of the safest countries in the world, with low crime rates and a strong sense of community. This provides a secure environment for entrepreneurs and their families to live and work.

Andorra’s location between Spain and France offers entrepreneurs a number of strategic advantages. With its close proximity to Spain and France, Andorra offers easy access to the vast European market, enabling entrepreneurs to expand their business operations and reach a larger customer base. Entrepreneurs in Andorra can also benefit from the resources and opportunities available in the larger European community, such as skilled labor, funding, and partnerships.

The Andorran government is committed to creating a business-friendly environment that fosters growth and innovation. Andorra offers a range of government incentives and support programs to help entrepreneurs establish and grow their businesses, including financing options, streamlined bureaucratic processes, and access to business advice. Additionally, Andorra’s startup ecosystem is continuously developing, with an increasing number of resources, events, and networks available to support entrepreneurs, providing a nurturing environment for new businesses to thrive and innovate.

Types of Residency in Andorra for Entrepreneurs

There are two main types of residency in Andorra for entrepreneurs, namely active residency and passive residency, each with its own unique features and requirements.

Active residency is suited for entrepreneurs who wish to actively manage their businesses in Andorra, which includes setting up a company or being self-employed. To qualify for active residency, entrepreneurs must own a majority share in a local company or demonstrate their self-employed status. Additionally, they must reside in Andorra for at least 183 days per year and contribute to the Andorran social security system. Active residency allows entrepreneurs to take full advantage of the country’s favorable tax rates and actively participate in the local business community.

Passive residency, on the other hand, is ideal for entrepreneurs who do not need to be physically present in Andorra to manage their business activities. This type of residency is popular among investors, retirees, and remote workers. To be eligible for passive residency, applicants must demonstrate a minimum annual income from sources outside Andorra and make an investment in the country, such as purchasing real estate or government bonds. Passive residents are required to spend at least 90 days per year in Andorra and must also have a valid private health insurance policy that covers them while in the country.

Application Process for Andorran Residency

The application process for obtaining residency in Andorra is straightforward and well-organized. It begins with preparing the necessary documents, which include a valid passport, proof of income, a criminal record certificate, and a medical certificate, among others. Some of these documents may require official translations and apostilles, so it is essential to plan ahead to ensure a smooth application process.

Once the documents are prepared, the applicant can submit their application to the Andorran immigration authorities. It is advisable to work with a local professional, such as a lawyer or consultant, who can provide guidance throughout the process and ensure that all requirements are met. This can help avoid delays and increase the chances of a successful application.

After submitting the application, the applicant may be required to attend an interview with the immigration authorities to discuss their personal and professional background, as well as their plans for living and working in Andorra. Depending on the type of residency applied for, there may also be an inspection of the applicant’s proposed business or investment.

Upon successful completion of the application process, the applicant will receive their residency permit, which allows them to live and work in Andorra. The entire process can take several months, so it is crucial to be patient and prepared for any potential delays.

Maintaining Residency in Andorra

Once residency is obtained, it is important to adhere to the terms and conditions of the permit in order to maintain it. This includes meeting the minimum residency requirements each year and paying any applicable taxes and social security contributions on time. It is also essential to keep all documents up-to-date, such as passports and visas, in order to avoid any issues with the immigration authorities.

Finally, it is important to stay informed about any changes in the local legislation that could affect entrepreneurs’ rights and responsibilities in Andorra. This can help ensure that businesses are operating legally and can benefit from all of the resources available to them in the country. By taking these steps, entrepreneurs can enjoy a successful and rewarding experience living and working in Andorra.