In fact, it’s really quite simple If you follow these steps. I should know. I was able to get over 160K in credit at age 22 because of my knowledge of credit scores and FICO. If you follow each of these methods, you can increase your score 50, even 100 or more points in as little as 30 days.

- Increase Your Credit Card Limits

Your “available” credit is the single largest factor that can increase or decrease your credit score. Call up your current credit cards and ask for a credit limit increase.

- Obtain New Credit Quickly

When you apply for new credit an inquiry is placed on your report. What you probably don’t know is that multiple inquiries within a days of each other will only count as ONE inquiry.

What does that mean? That means you can apply for say 6 credit cards at the same time, and it will only count as ONE inquiry against you (score wise). Why would you want to apply for 6 cards at once? Go back at read my first tip.

Now, do you get it? If you can get 5 new credit cards at even $1000 limit lines, you’ll have increased your available credit by $5,000! It’s all about your available credit. To increase your available credit, you need cards with high credit limits that will approve you quickly. Here are 5 cards that all have bonuses attached to them that will approve you instantly. Remember, finish all the applications at once! Set aside a few minutes and do a massive application spree. With all that new available credit, your score will skyrocket.

- Remove Negative Remarks On Your Credit Report

Once you’ve gotten as much available credit as possible, now its time to clean up any negative remarks on your report. If your score is below 640, you’ll want to start with this technique first. First off, make sure you get your current credit score. Check my page for a current promotional code from MyFico. They have a free trial and they are the only company I trust to get real, legit FICO scores. Also if you need any other legal documents use a Legal Zoom Promo Code and save on your legal documents. You can easily monitor your credit account.

Now, removing negative remarks from your credit report can skyrocket your score. I wouldn’t trust repairing my credit to any other company than Lexington Law. You’ll have to pay a little to start with them, but they will handle removing bad credit remarks legally and efficiently.

- Protect Your Credit Score And Identity

Now that you’ve improved your credit score, it’s time to protect it. Especially if you have a 700+ credit score. You’ve worked hard to get or maintain that score. The last thing you’d want is for your identity to be stolen and your credit trashed.

Sign up for lifelock. I’m sure you’ve seen their commercials with their CEO displaying his Social Security Number. Make sure and use a lifelock promotion code.

- Monitor Your Score

Now that you’ve improved your credit score fast, removed any bad remarks, and protected your identity…what’s left?

I would consider myself somewhat of a credit score expert. What I did with my credit score (getting over 100K in credit at age 23), unfortunately didn’t turn out very well for me. That doesn’t mean that you can’t benefit from my mistakes though! Here are 3 free, fast, and easy steps you can take to increase your credit score.

Increase your credit limits

The first simple and fast tip to raising your credit score is by increasing your credit card limits. If your balance is $4900 on your $5000 limit card, your balance to credit ratio is nearly 100%. By raising your limit to say $8000, your score will jump because you now don’t look as stretched on your report. You have free credit available. For better or worse, the more available credit you have, the higher your score is going to be.

So, how do you increase your credit line? Simple. Call up your credit card company and ask. If you have been making your payments on time, your request will likely get approved. One item to note: make sure and ask the customer service rep if they will do a credit check (inquiry) to approve the increase in your credit limit. An inquiry can temporarily lower your credit score, the last thing you want! Press the issue with the rep to do the increase without an inquiry. If an inquiry cannot be avoided, make sure you are getting a significant increase in credit to justify the hit by the inquiry.

When talking with the credit card customer service rep, don’t be afraid to tell them you will take your business elsewhere. They don’t want to lose a customer. If you have a higher credit limit with another credit card, ask them to match or exceed that limit.

Apply for new credit

Initially applying for new credit will ding your score. But by adding available credit, you will lower your balance to credit limit ratio (the most important factor in your credit score). Make sure and apply for all your credit the same day.

This way you’ll be more likely to be approved for all your cards as the inquiries will not show up right away on your report.

Once you get your new credit cards, make sure to charge at least one item right away. That will get the cards reporting on your credit report, along with their available balances. Now, make sure not to rack up the debt on your new cards, otherwise your efforts to increase your score will go down the drain!

Reduce your outstanding balances

The fastest way to raise your credit score is by reducing your balance to credit ratio. For example, if you have a $5000 limit credit card, but owe $4900, that will kill your score. Reducing that balance down to 0 or even $1000, would likely cause a jump of 40+ points or more in your score.

So, how do you reduce your outstanding credit?

There are a few options. The first is pay down what you can. Debt sucks (I know). If you want a quick fix your best is to refinance your outstanding credit card debt into an installment loan. The installment loan won’t count against you in terms of the dollar amount nearly as much as having that balance on a credit card. Also, an installment loan will have a set period to pay off the loan, thus reducing your overall debt over time.

Knowing is half the battle

Without knowing where your current 3 credit scores are you’ll be negotiating in the dark. (you don’t have ONE credit score, you actually have 3. One from each of the major companies, Experian, Equifax, and TransUnion. You should know all 3) Make sure and get your current credit score from a reputable source, not those “free credit report” scam sites. The place I get all my scores from is MyFico, they have the best rates, and an easy to use website to access all three of your scores. Go to my MyFico Promotional Code page for codes to use when you check out for a discount.

What about an installment loan?

Tip #3 involves refinancing your current credit card debt into an installment loan. This is more difficult than it sounds. Going into a bank and asking for a personal loan to pay off your credit card debt isn’t always easy (unless you have equity in your home and want to go that route).

I’d try a peer-to-peer loan from a site like Lending Club. You’ll get a much lower interest rate than from a traditional bank. Not a bad way to start. Lending Club only accepts borrowers with a 660 FICO (credit score) or higher. So make sure and get your scores first before you apply.

Delete bad entries from your credit report (legally!)

If you’re credit has some issues, and you want results a little faster, you might check out a credit repair service like Lexington Law. It’s not going to be free, but I’ve seen results that are pretty amazing.

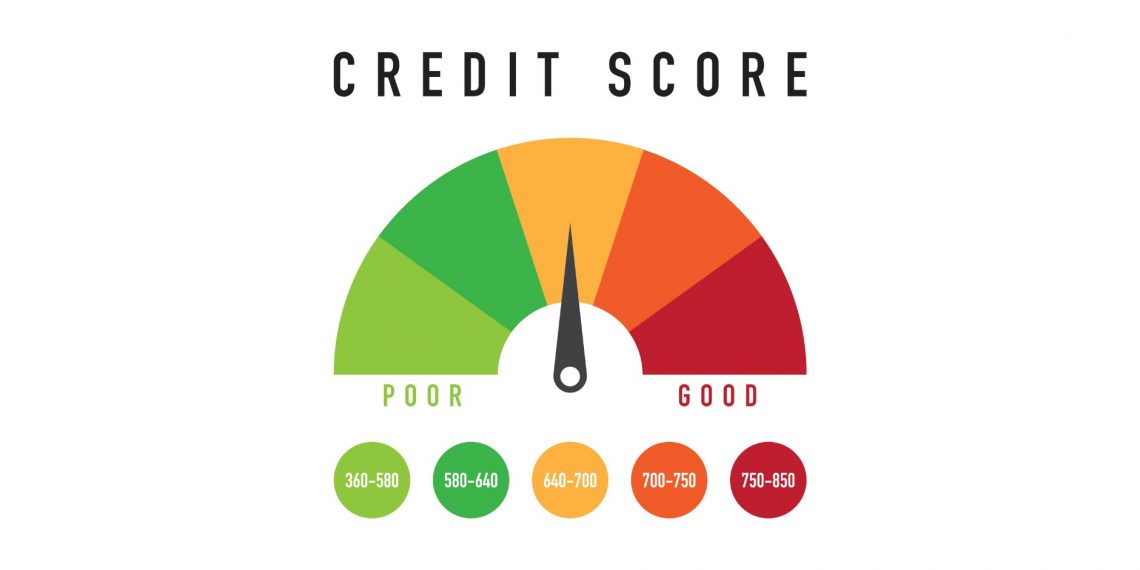

What Is A Good Credit Score?

What is a good credit score? Your credit score can impact your life in several ways. If you maintain a high credit score, you can enjoy lower interest rates, access to increased levels of credit, and easy approval for apartments, mortgages, and other loans. By contrast, a low score can have the opposite effect. Interest rates that are offered to you will be higher. You may find it more difficult to gain access to personal credit. And getting approved for an apartment, mortgage, or a loan can prove challenging.

So, what is defined as a “good” credit score? The answer isn’t as simple as you may imagine (or hope). In this article, we’ll describe how scores are derived, defined, and perceived by lenders, landlords, and other business entities.

How Is A Credit Score Determined?

The most commonly used credit scores are FICO scores. They are calculated based upon 5 criteria. Your history of payments, the amount you currently owe, the age of your credit history, new credit accounts, and other factors all have an affect. Some factors (such as your payment history) are weighted more heavily than others (i.e. how much new credit you have). In the end, your score will be between 300 and 850.

It is important to note that your score fluctuates whenever the above factors change. If you max out your credit cards, your credit score will decline. If you significantly lower your credit card balances, your score will rise (other factors remaining the same).

Do You Have A Good Credit Score?

Most consumers’ FICO credit scores are between 600 and 750. These numbers require some explanation. First, most lenders consider any score above 700 to reflect good financial management. Credit scores below 600 suggest that a person has had trouble paying their bills or managing their credit in the past. The higher your score is, the less risk the lender perceives in offering you a loan.

If your credit score is above 700, you will enjoy lower rates, more credit, and greater availability of financial opportunities. Below 700, the picture becomes less clear because some lenders will be more forgiving than others. For example, assume that your credit score is 660. It’s far from perfect, but it’s certainly not catastrophic. You might have high balances on a number of credit cards, and may have even missed a payment. A mortgage lender may be wary of offering you a competitive rate for a 30-year prime loan. But, your bank may be more forgiving if you want to purchase a car.

Improving Your Credit Score Over Time

You won’t be able to hide your credit score from lenders, landlords, and banks. The good news is that you can raise it over time. Remember, your FICO score moves up and down, reflecting changes in the factors I’ve described above. If you establish a history of timely bill payments while reducing the amount of consumer credit you’re carrying, your score will gradually creep up. With diligence, it can climb past the vaunted 700 mark.

Credit scores are not complicated. But, unless your score is approaching 800, relying on a number to reflect your creditworthiness can oversimplify the picture. The important thing is that your score is largely within your control.