Every year, millions of newbies try their hand at investing and trading. Some of the newbies fail, while others by spending some time learning modern financial trading technologies can increase their chances of success.

Let’s define what to look for as a broker, how to choose assets, how to build your strategy, and how to make your first trade.

Table of Contents

Step 1: Find a Trustworthy Broker

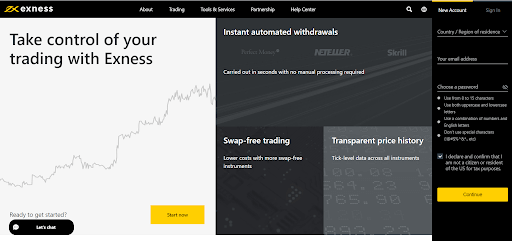

Exness is a financial technology leader that offers innovative financial technologies, outstanding customer support services, and some of the best trading possibilities in the industry.

The work of the Exness Forex broker is controlled by the following reputable and well-known financial authorities, such as:

- CySEC, 178/12 (Exness (Cy) Ltd);

- FCA (UK), 730729 (Exness (UK) Ltd).

Benefits of Exness:

- dealing on Forex, CFDs on futures;

- metal-currency accounts for long-term investments;

- hedging transactions with the introduction to the interbank market;

- free access to the VPS service, which provides advanced opportunities for using automatic systems for clients with a deposit of more than $ 500;

- access to the archive of quotes for technical analysis, subsequently using the data for testing strategies;

- partnership and loyalty programs;

- automatic withdrawal of funds without limiting the amount, 24/7;

- multilingual support 24/7.

Loyalty Program by Exness

The broker has created a special program to apprise loyal customers for their valuable endowment to Exness’s success over the past decades.

The principle of its procedure is straightforward: the more trading volume reaches clients, the better the prize that you, as a partner, will receive.

For a Premier Elite membership, a trader will receive all the benefits of a premier preferred membership package, plus a dedicated account manager to help with specific business demands.

Types of Exness Accounts

Exness can be used by every trader. It proposes two major types of accounts, each created for different trading strategies: a standard one and professional.

Each of them has its own set of ambiance for fees, margin requirements, and leverage, among many others.

Standard accounts:

- Standard

- Standard Cent

Professional accounts:

- Pro

- Zero

- Raw spread

For the standard account type, the minimum deposit is $ 1 and you can instantly start trading. For the professional account types, the minimum deposit is $ 200.

Step 2: Open a Trading Account

Creating and managing your Exness account is an easy and clear process. Let’s take a look at it.

First, create a personal account on Exness. Go to the website: https://www.exness.com/ to start registration. Fill in all the fields with valid information, such as the country of your residence, the email address. Create a unique password, which will be used to enter your personal area.

You can either open a Demo-account to get some practice without investing money or if you are an experienced broker and feel confident enough, you can proceed with real-time trading.

Confirm and Verify the Account

To do so, a trader has to fill out an email and phone number, provide proof of identity (POI) and proof of residence (POR). We need to review these documents to make sure that you, the real owner of the account, are doing all of the transactions on the account.

Step 3: Place the First Deposit

Once the account is set up, a trader can make the first deposit and start trading. The broker offers a wide variety of deposit methods. In many ways, the choice depends on the country of residence of a trader.

Step 4: Choosing the Trading Terminal

You can use MetaTrader 4 (MT4) or MetaTrader 5 (MT5), which are the most popular Forex platforms among Forex dealers without downloading the trading software.

Step 5: Start Trading

There are several possibilities to open a trade. A trader has to choose from the ‘buy’ and ‘sell’ options at the top left of the chart. It is advisable to double-click a currency pair in the list. Right-click on the chart when you are ready to place your first trade. It’s time to set the trading volume based on how confident you are in the forecast direction. This is also the perfect time to set your stop loss and take profit. Click the arrow to the right of the Stop Loss and Take Profit prices.

Fill in all obligatory fields:

Symbol: Select a trading tool from the drop-down list that displays the symbols.

Order type: select either a market execution or a pending order. Pro accounts also have access to Instant Execution.

Volume: Enter the lot size (the volume you wish to trade) for your order. The size of the lot depends on the type of account.

Deal type: choose “Buy” or “Sell” as you wish.

Step 6: Close the Deal

There are two ways to close an open deal in Desktop Terminal or WebTerminal:

- Click X on an open trade located in the right corner of the “Trade” tab.

- Right-click an open trade in the Trade tab and select Close Order.

Remember, the trade can not be closed automatically, besides of a pending order or stop-out.