The Credit Information Bureau (India) Ltd, best known as CIBIL, is the premier agency for providing credit reports and scores pertaining to individuals. CIBIL offers financial data of individuals such as information from leading banks and other financial institutions in India, including loans and credit cards. These details was submitted as a credit report from CIBIL also known as a credit information report (CIR).

In the year 2000, CIBIL was incorporated and its presence in the whole country continues to increase. This is sponsored by the main global lending agencies Transunion International and Dun and Bradstreet.

Table of Contents

WHAT IS A CIBIL SCORE?

A Reserve Bank of India (RBI) approved credit agency, the Credit Information Bureau (India) Ltd., popularly known as CIBIL. This provides individuals with CIBIL scores and CIBIL reports. After the comprehensive credit information is considered, the office produces a CIBIL score. The agency also provides banks and other NBFC with credit reporting services (Non-banking financial companies). A 3-digit CIBIL score is the lowest of 300-900, which reflects a creditworthiness for a person. A higher CIBIL score implies good credit history and responsible returns. Based on the historical financial data of an entity, the values of CIBIL are determined on a minimum of 6 months. The data is fed into an algorithm with a different weight of 258 variables.

HOW TO CHECK YOUR CIBIL SCORE ONLINE STEP BY STEP:

Steps to check your CIBIL score:

Step 1: Go to the official CIBIL website https://www.cibil.com/.

Step 2: Select ‘Get your CIBIL Score’.

Step 3: Click on “Click here” to get your free Annual CIBIL Score.

Step 4: Type in your name, email ID, and password. Attach an ID proof (passport number, PAN card, Aadhaar or Voter ID). Then enter your PIN code, date of birth, and also your phone number.

Step 5: Click on ‘Accept and continue’.

Step 6: You will receive an OTP on your mobile number. Type in the OTP and select ‘Continue’.

Step 7: Select ‘Go to dashboard’ and check your credit score.

Step 8: You will be redirected to the website, myscore.cibil.com.

Step 9: Click on ‘Member Login’ and once you log in, you can see your CIBIL score.

WHAT IS A GOOD CIBIL SCORE?

A good CIBIL score is a 700 to 900 CIBIL score. Many benefits such as a fast approval, low credit interest rate, higher loan amount, longer maturity period, and many more will accompany a good CIBIL score. A good amount will be added. In addition, many lenders are prepared to accept your loan so you can pick the loan from which the loan will be lent.

A good CIBIL loan score is the same as any other loan, i.e. between 700 and 900. A good score means that your loan application is accepted more efficiently. If you are looking for a personal credit, a car credit or a home loan, a score over 700 is fine.

A lower interest rate, longer pay-back period, higher loan amount and more can be achieved with a strong CIBIL ranking. Furthermore, this results in a faster and simpler method of recording.

If you have a CIBIL score between 700 and 900, you should expect up to 80% of the overall cost of the property when it comes to a home loan. However, in the event of a personal loan, certain requirements cannot be laid down because it is an unsecured loan. The amount of the loan can vary depending on the loan and the score that you quote. With regard to a car loan, you do not have a certain score. A score higher than 700 is recommended to remain optimistic when applying for a car loan.

WHAT IS A BAD CIBIL SCORE?

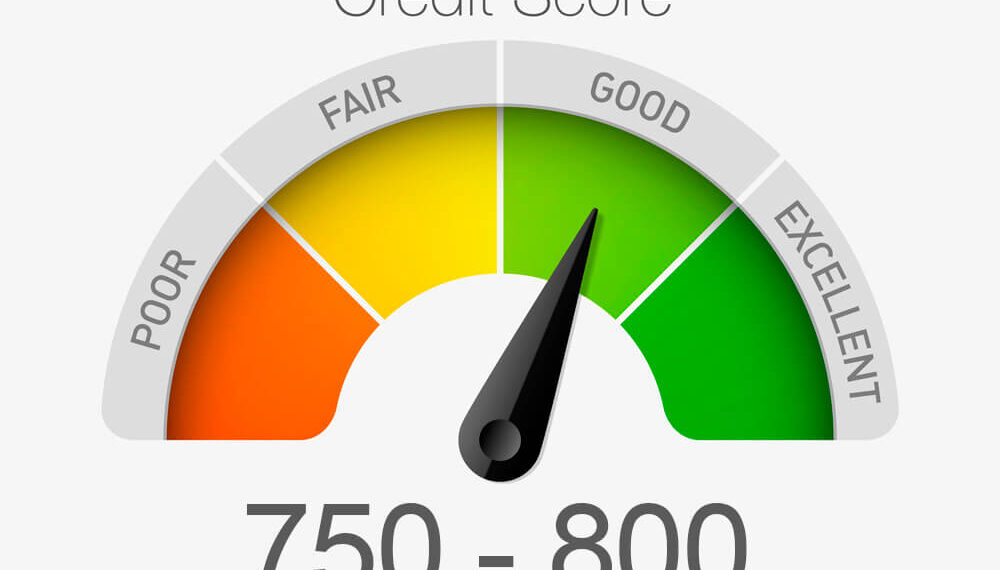

A credit score is a numerically presented indicator of your creditworthiness. It ranges from 300 to 900, the lowest to the peak of 300. You should always strive to keep the credit score near 900. Most banks and NBFCs assume that 750 or higher credit values are desirable. Let’s look at the various scope of credit:

| Bad | 300-500 |

| Average | 550-650 |

| Good | 650-750 |

| Excellent | 750-900 |

A 300-550 credit score is regarded as poor. You would need to take drastic steps to boost it if you have a credit score that is below this range. If you have a poor credit score, you won’t get a loan or a credit card.