Given that the nation’s top financial regulator must supervise a record number of companies releasing information this year, incorporate an ambitious program of new draft legislation, and further restrict cryptocurrencies and special purpose acquiring companies, proponents for financial-market oversight.

Biden’s fiscal policy 2022 spending plan calls for approximately $6 trillion in spending, up 35% from which was before spending more than $4.4 trillion which is also a result of only 5% increase, which is directly less than the budget increase for the last 25 years.

Proponents for financial reform argue that the nearly $2 billion funding bill is excessively conservative, given the general willingness to invest more and the fact that the funds in the SEC are accumulating from the fees that the industries are paying and it is the authority that sends more money to the Treasury than vice versa. It is surprising since the budget, in this case, is wholly made up of financial penalties firms and individuals who are the rule-breakers.

Tyler Gellasch is the CEO of the Healthy Markets Association who has been stating that the agency has been under pressure from many different directions. He stated that this involves enacting a new climate risk disclosure standard, enforcing regulations for a fast-increasing universe of public firms, coordinating with international colleagues, and regulating the burgeoning cryptocurrency sector. Gellasch continued that the agency is expected to perform a number of things at the same time that it has not traditionally done. This is not a fundamentally different budget request that we have seen before, it is also difficult to see how they will fit all of the new stuff into this budget.

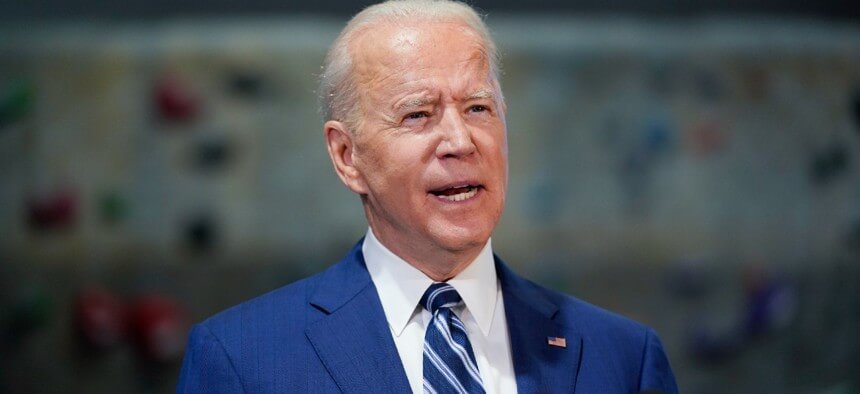

The same idea is also shared by the Chairman of SEC Gary Gensler,

He was struck by the scope of the capital market and the work of the agency since joining the SEC last month, noting that the regulator oversees a $100 billion capital market that includes 28,000 registered entities, there is also a list of major Forex brokers affected by the new plan, to put them into numbers, more than 3700 broker-dealers, and 2300 organization that is self-regulatory.

He also said that the SEC’s personnel has decreased by 4% in the last five years, while the number of registered investment advisors under its jurisdiction has climbed by 2000 and their individual clients have climbed by 20% to 48 million. The SEC has not developed to meet the requirements of the 2020s as our capital markets have developed. However, the SEC has not made any comment on the president’s budget proposal.

The president of the non-partisan reform organization, named Better Markets, Dennis Kelleher has said in his comment that the SEC is the best authority to request for a larger budget because the money that is accumulated in its budget comes from the small fee on financial market transactions and also from penalties, that have made the fraudulent activities. Mr. Hellher said that one can treble the SEC budget and it would not even make a dent in the entire budget picture, and those who pay taxes would not have to pay even a penny. The most terrible part is that until there is a catastrophe, financial regulation is not a hot topic and discussed the way it should be, and when the result happens, sometimes the actions are too late.

Pennsylvania Senator Pat Toomey, who is the senior Republican on the Senate Banking Committee, finally explained why he voted against Gensler’s confirmation in April. He said that the Sec’s purpose includes supporting capital creation as well as ensuring the markets are fair, and efficient at the same time. The SEC does not have the obligation or authority to utilize its regulatory power to promote a liberal social agenda on topics like global warming, political expenditure, or even diversity. He is afraid that based on Gary Gensler’s background and words during his nomination process, he would misuse the SEC and deviate from the SEC’S legacy of bipartisanship.

Only two Republican financial experts voted in favor of Gensler’s candidacy, compared to near-universal Republican support for the previous Democratic administration’s two choices for the position. A significant boost in the SEC’s budget would allow the agency to approve additional rules in the future years that are likely to be opposed by Republicans. Advocates for more SEC financing are perplexed by the SEC’s refusal to request additional funds, even if Congress would eventually reject the request. A rise of less than 3% for both compliance and inspections at the SEC is very inadequate in the context of the whole proposed budget.

With that, as a result, they are already a year behind in full-fledged examinations of registrants and other regulated companies, the agency will battle merely to keep up, especially given the massive rise in IPOs and SPACs, social media disruptions, and increased market leverage difficulties. They all have seen what happens when the major regulator is one step ahead of the industry and market behaviors and it is never good.